Using AI to analyze (and buy) Artificial Intelligence stocks

This is most definitely not investment advice!

If you are AI Curious or AI Enthusiast and you have at least $30 [1] of your hard-earned dollars that you want to invest in an AI future, here's an easy, super accessible way to make a bet on artificial intelligence by using AI to learn about the market.

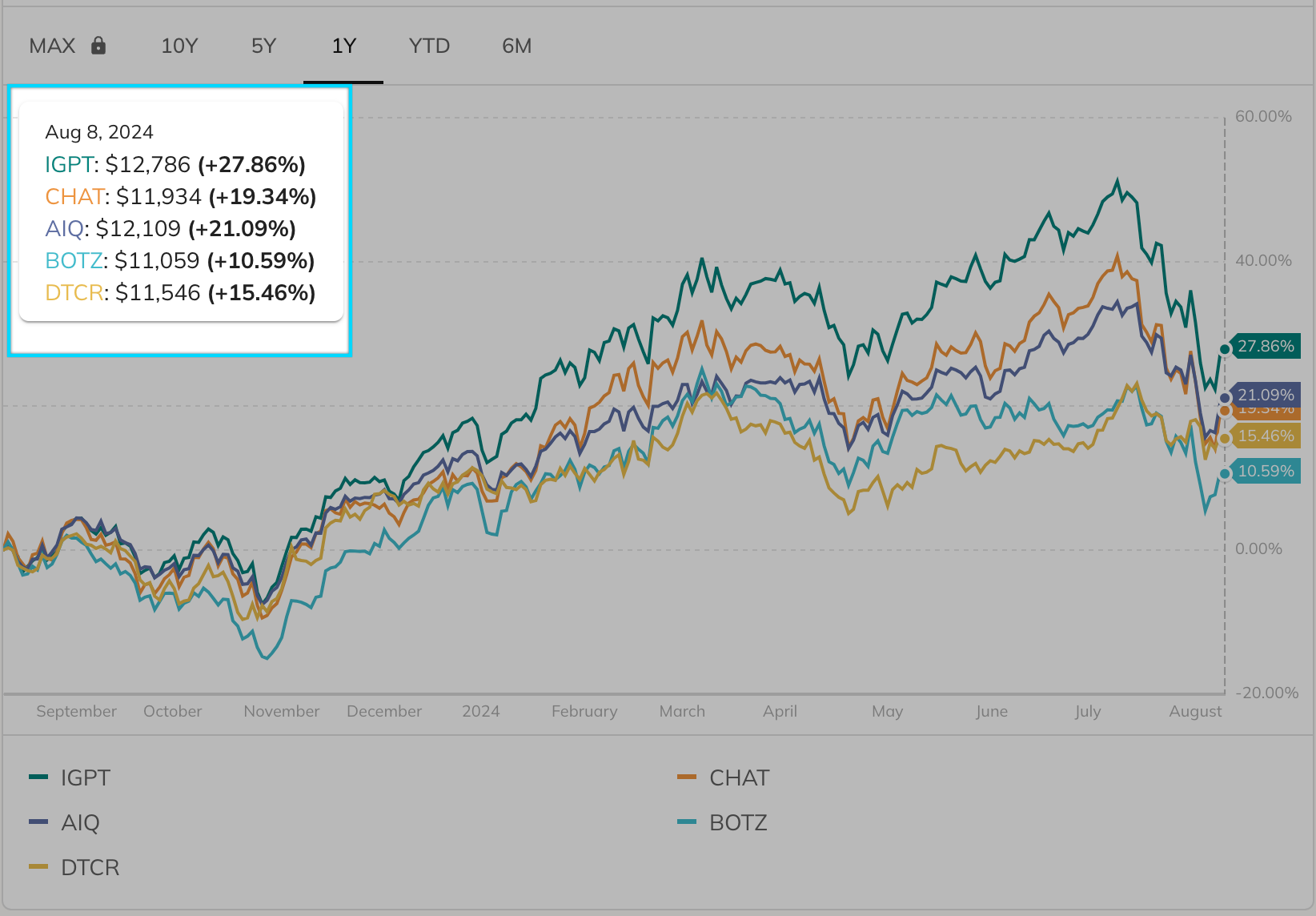

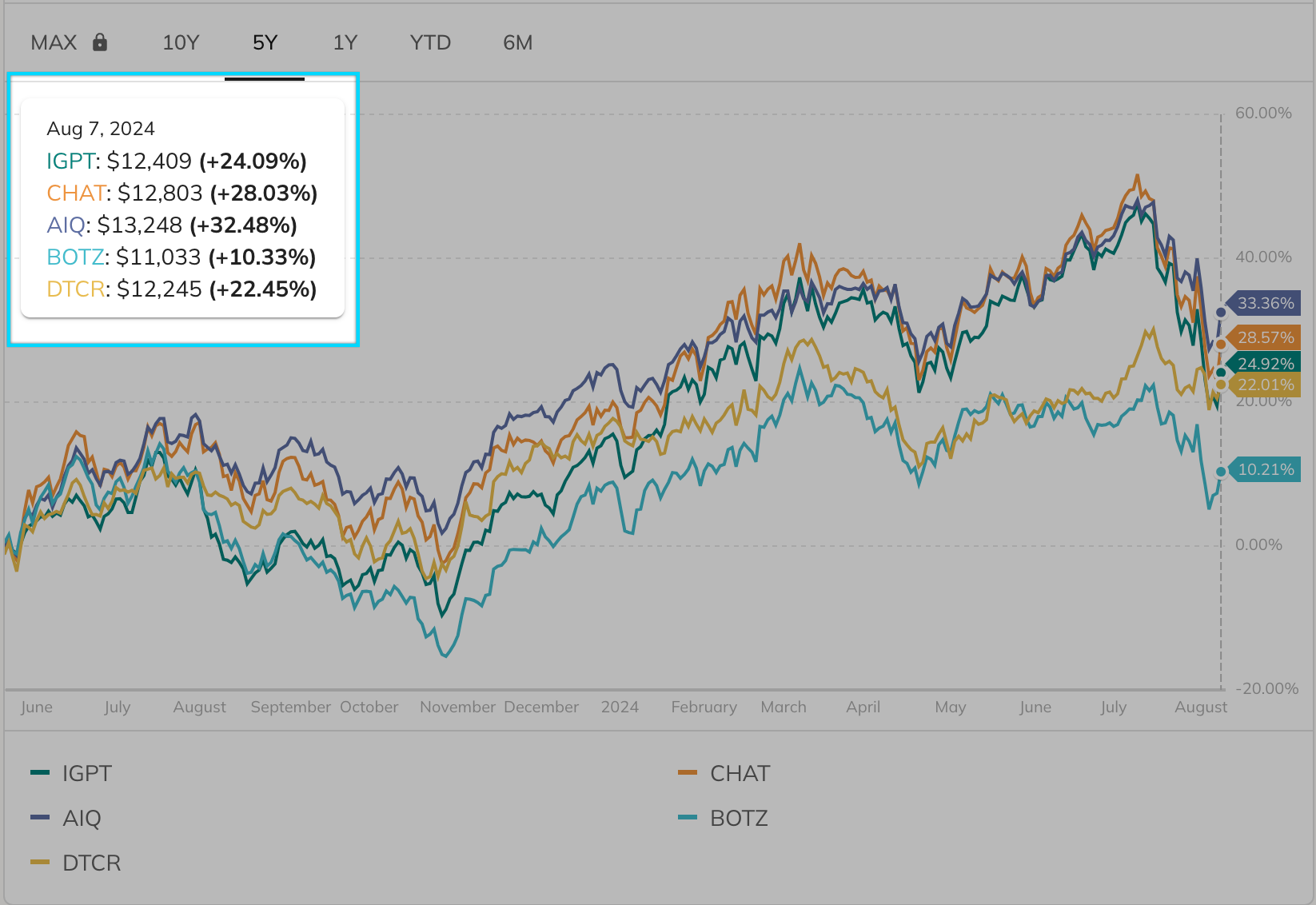

Artificial Intelligence ETF Performance:

I ran an analysis of the top performing ETFs [2] that are focused on artificial intelligence over the past 12 months and the max timeframe since inception. Here's how they compared:

Trailing 12 month performance:

IGPT, AIQ and CHAT were in the top three.

Max trailing performance (from May 2023):

Again, IGPT, AIQ and CHAT were in the top three, and 2 of 3 outperformed the S&P500 over the past 12 months and the max period:

I wanted to learn more about these ETFs!

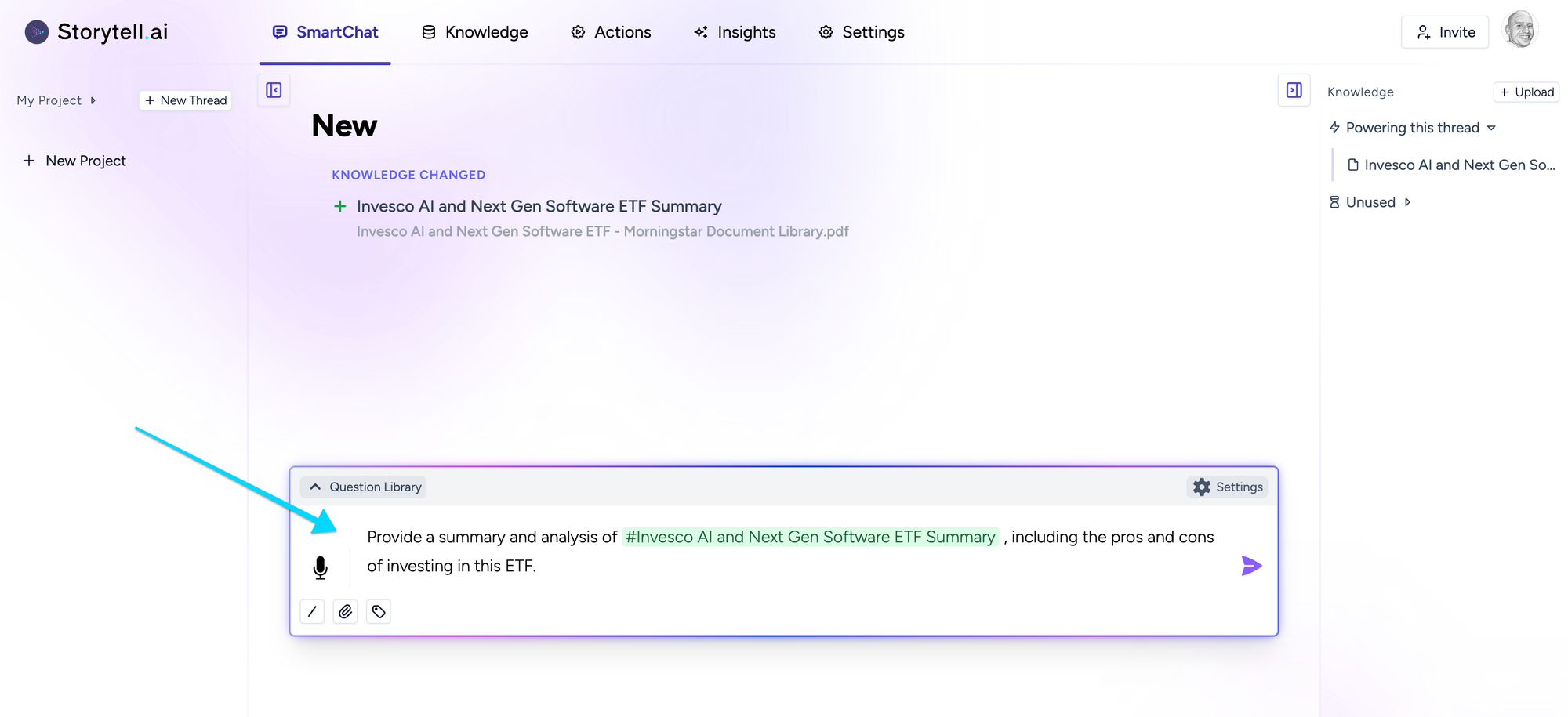

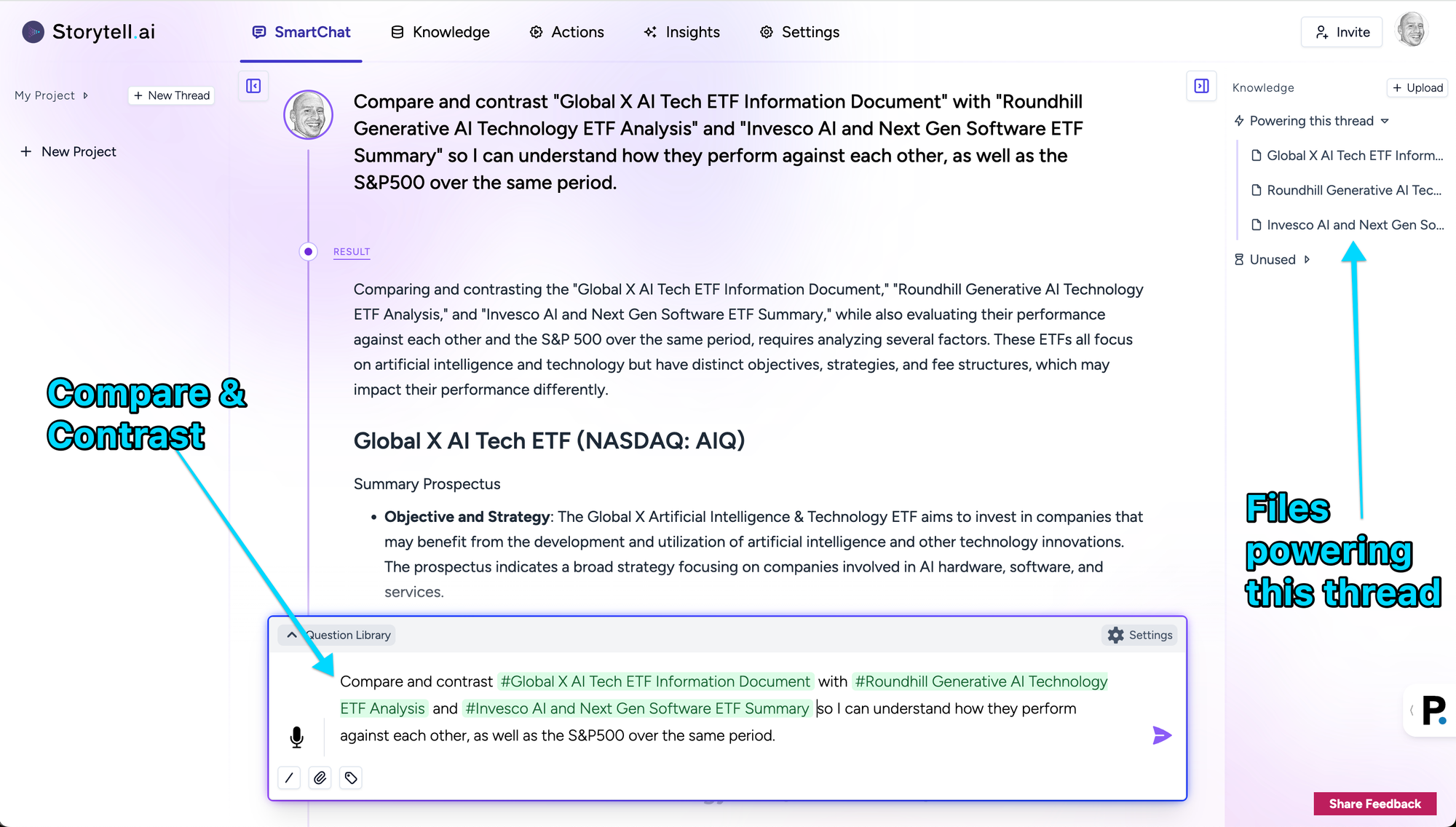

Using Storytell.ai to learn about IGPT, AIQ and CHAT

I wanted to better evaluate these top three AI ETFs. To learn more about them, I ran the (very dense!) prospectus of each through Storytell. Here's how I did it:

I also used Storytell to compare and contrast the three ETF prospectuses with each other:

And here's what I learned:

IGPT: Invesco AI and Next Gen Software ETF

Storytell Summary:

The Invesco AI and Next Gen Software ETF (Ticker: IGPT), previously known as the Invesco Dynamic Software ETF, aims to track the investment results of the STOXX World AC NexGen Software Development Index. This index comprises securities from companies significantly involved in future software development, especially in areas like artificial intelligence (AI) and robotics.

Key Points:

- Fees and Expenses:

- Management Fees: 0.50%

- Other Expenses: 0.11%

- Total Annual Fund Operating Expenses: 0.61%

- After certain fee waivers, the expense reduces to 0.60%.

- Portfolio Turnover: 190%, indicating a high turnover rate, which can lead to increased transaction costs and potential tax implications.

- Investment Strategy: At least 90% of the Fund's total assets are invested in securities from the underlying index. The index includes companies across large, mid, and small-cap from developed and emerging markets that derive substantial revenue from software development.

- Inclusion Criteria: Securities must be part of the STOXX World AC All Cap Index, have a market cap greater than €500 million, and a trading volume exceeding €1 million.

Analysis

Pros:

- Exposure to Growing Sectors: Investing in this ETF provides exposure to cutting-edge sectors like AI and robotics, which are expected to grow significantly.

- Global Diversification: The underlying index includes companies from both developed and emerging markets, offering geographic diversification.

- Professional Management: The ETF is managed by professionals, ensuring that the securities selection aligns with the growth and future potential of the included technologies.

- Reasonable Fees: An expense ratio of 0.60% is relatively reasonable given the specialized nature of the ETF.

- Strategic Index Composition: The underlying index is well-curated to include companies with substantial revenue from future software development, ensuring focused investment.

Cons:

- High Portfolio Turnover: The 190% turnover rate can lead to higher transaction costs and tax liabilities for investors, potentially affecting the Fund's performance net of costs.

- Market Risks: As with any equity investment, there are inherent market risks. The sectors targeted by the ETF can also be highly volatile and subject to rapid technological changes.

- Foreign and Emerging Market Risks: Inclusion of foreign and emerging markets introduces currency risk, political risk, and other uncertainties that can affect investment performance.

- Sector Concentration Risk: The focus on next-gen software and AI means that adverse developments in these sectors could significantly impact the fund’s performance.

- Complexity and Specificity: The specificity of the investment focus might not be suitable for all investors, especially those looking for more diversified or less volatile investment options.

Conclusion

The Invesco AI and Next Gen Software ETF is an attractive option for investors seeking growth opportunities in technologically advanced sectors like AI and robotics. While it offers the potential for high returns due to its targeted approach, it also carries notable risks, including high portfolio turnover and sector-specific risks. Investors should weigh these factors against their investment goals and risk tolerance before investing.

CHAT: Invesco AI and Next Gen Software ETF

Based on the content provided from the document titled "Roundhill Generative AI & Technology ETF - Morningstar Document Library," here is a summary and analysis:

Storytell Summary

Fund Overview:

- Name: Roundhill Generative AI & Technology ETF (Trading Symbol: CHAT)

- Listed on: NYSE Arca, Inc.

- Inception Date: May 15, 2023.

Investment Objective:

- The fund aims for long-term capital appreciation.

Fees and Expenses:

- Management Fees: 0.75%

- Other Expenses: 0.00%

- Total Annual Fund Operating Expenses: 0.75%

- The adviser will cover all other expenses except advisory fees, interest charges, dividends on securities sold short, taxes, brokerage commissions, acquired fund fees and expenses, deferred tax liability, distribution fees under Rule 12b-1, litigation expenses, and non-routine or extraordinary expenses.

Expense Example:

- 1 Year: $77

- 3 Years: $240

- Assumes a $10,000 investment with a 5% return each year.

Analysis

Pros:

- Focused Growth Theme: The ETF targets the burgeoning field of generative AI and technology, promising sectors with potentially high growth rates.

- Low Expense Ratio: With a total annual fund operating expense of 0.75%, this ETF is relatively cost-effective, which should appeal to cost-conscious investors.

- Adviser Payment of Certain Expenses: The fund's adviser absorbs many routine expenses, potentially easing the operational cost burden on the fund.

- Long-term Appreciation Goal: The ETF's strategy of seeking long-term capital appreciation may be appropriate for investors with a long-term investment horizon.

- Accessibility: Listed on NYSE Arca, the ETF is easily accessible for most investors who have access to U.S. stock exchanges.

Cons:

- Sector Concentration Risk: The fund is highly focused on the AI and technology sectors, which can increase its volatility and risk due to lack of diversification.

- High Competition: The technology and AI sectors are highly competitive and subject to rapid changes, which could adversely impact the fund's holdings.

- Early Stage Investment Risk: Generative AI is an emerging field, and many companies in this space may not yet be profitable or stable.

- Potential for Higher Actual Costs: The example cost scenario does not include brokerage commissions, which could add to the overall investment cost.

- Dependence on Advisor: The reliance on the adviser to cover many expenses could pose a risk if the advisor alters this policy or faces financial difficulties.

Conclusion

Investing in the Roundhill Generative AI & Technology ETF (CHAT) offers potential benefits for those looking to capitalize on growth within the generative AI and technology sectors, with relatively low direct expenses. However, it carries inherent risks due to its high sector concentration and the evolving nature of the AI field. Investors should weigh these pros and cons based on their risk tolerance, investment horizon, and costs beyond the stated management fees.

AIQ: Invesco AI and Next Gen Software ETF

- Here's the AIQ Prospectus

- You can chat with the Storytell summary right here

Storytell Summary:

The "Global X Artificial Intelligence & Technology ETF (AIQ)" document provides a summary of the investment strategy, objectives, and associated risks of the ETF. This summary is part of a larger prospectus and supplementary information available through Global X’s and Morningstar’s documentation.

- Fund Objective: The primary goal of AIQ is to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Artificial Intelligence & Big Data Index.

- Strategy: AIQ invests in companies that benefit from the development and utilization of artificial intelligence (AI) and big data technologies. These may include sectors such as technology, healthcare, finance, and consumer goods.

- Documentation: The prospectus, semi-annual and annual reports, and the statement of additional information are available online and can provide detailed insights into the fund's operations, holdings, and financial health.

- Risk Factors: Potential investors are cautioned to consider the risks associated with investing in AI and technology sectors, which can include market volatility, regulatory changes, and the rapid pace of technological advancement.

Analysis

Pros of Investing in AIQ

- Growth Potential: The AI and technology sectors have high growth potential as technological advancements continue to drive economic and industrial transformations.

- Sector Diversification: AIQ provides exposure to multiple sectors that benefit from AI and big data, reducing the risk associated with investing in a single industry.

- Innovation Exposure: As a thematic ETF, it focuses on innovative companies and technologies, which can capitalize on long-term technological trends.

- Accessibility: The fund offers a straightforward way to invest in a basket of companies operating within the AI and big data space, which might be challenging for individual investors to replicate.

Cons of Investing in AIQ

- High Volatility: The technology sector is known for its high volatility due to rapid changes and uncertainties in technological innovation and market demand.

- Regulatory Risks: The AI and technology sectors are subject to stringent regulatory scrutiny, which can impact the profitability and operations of the companies within this ETF.

- Concentration Risks: While the fund provides some level of diversification within the AI and big data theme, it is still concentrated in a specific niche, which can increase risk compared to broader market exposure.

- Market Risks: Broader market downturns can impact the performance of the ETF regardless of the promising prospects of the underlying technology sector.

Conclusion

The Global X Artificial Intelligence & Technology ETF offers an attractive investment vehicle for those seeking exposure to the growth prospects of AI and big data technologies. Its benefits include potential high growth and sector diversification, while its risks involve market volatility, regulatory uncertainties, and niche concentration. Potential investors should balance these factors against their individual risk tolerance and investment goals. Access to detailed fund documentation and performance reports can aid in making an informed investment decision.

Want to go deeper?

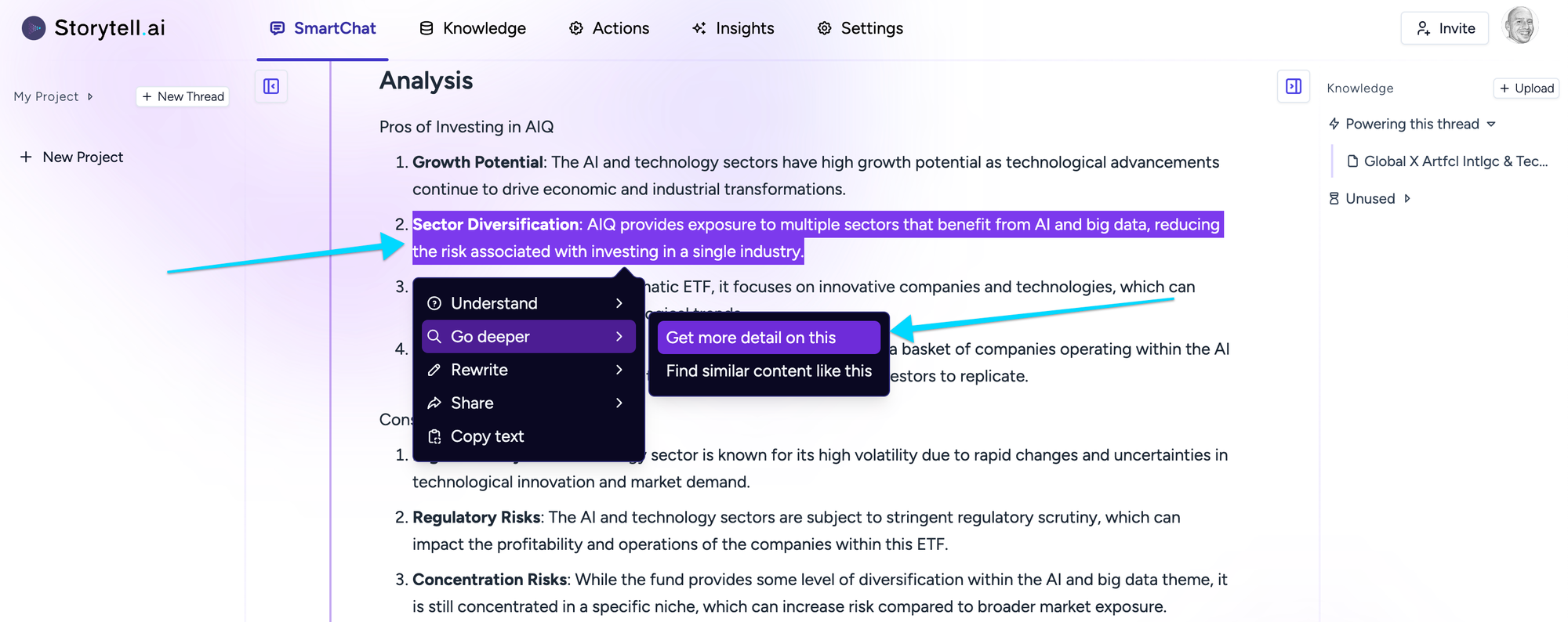

One of the nice features of Storytell.ai is the ability to highlight parts of the output and take more action on it, including better understanding it ("Explain it to me like I'm five!"), going deeper into the content, rewriting it & more. Here's an example:

Here's the Storytell output from the "more detail" request above:

(You can chat with this response more yourself, right here)

Sure, here's more detail as you requested:

Summary of additional details:

The Global X Artificial Intelligence & Technology ETF (AIQ) offers a diversified approach to investing in artificial intelligence (AI) and big data by spreading exposure across multiple sectors. This sector diversification mitigates risks associated with investing in a single industry, offering investors a balanced portfolio that taps into the widespread impact of AI technologies.

Specific points:

- Technology Sector: Encompasses companies directly developing AI tools and applications, which benefit from the increased demand for AI solutions.

- Healthcare Sector: Involves firms utilizing AI for medical research, diagnostics, and personalized medicine, supporting innovation in healthcare.

- Financial Services Sector: Includes companies applying AI for risk management, fraud detection, and algorithmic trading, enhancing financial operations.

- Consumer Discretionary Sector: Companies employing AI for personalized customer experiences, inventory management, and marketing to drive business efficiencies.

- Industrials Sector: Firms using AI for automation, predictive maintenance, and supply chain optimization, improving industrial processes.

- Energy Sector: Application of AI in energy management, exploration, and predictive analytics for more efficient energy production and distribution.

Deeper dive on additional details:

Technology Sector:

The Technology sector within AIQ includes companies that are at the forefront of developing AI technologies. This encompasses firms specializing in machine learning algorithms, neural networks, natural language processing, and other core AI technologies. By investing in these companies, AIQ taps into the foundational elements of AI development, which are crucial for driving innovation across various applications. This includes giants like Alphabet (Google's parent company), Nvidia, and Microsoft, which are heavily investing in AI research and development.

Healthcare Sector:

AI's transformative impact on the healthcare sector is profound. Companies in the healthcare sector within AIQ's portfolio are leveraging AI to revolutionize diagnostics, patient care, treatment personalization, and drug discovery. Examples include IBM Watson Health, which uses AI to analyze large datasets for cancer research, and companies like Medtronic, which use AI for developing advanced medical devices. This not only accelerates innovation but also improves patient outcomes and operational efficiencies in healthcare facilities.

Financial Services Sector:

In the Financial Services sector, AI's application ranges from algorithmic trading to risk assessment and fraud detection. The companies in this sector use AI to analyze vast amounts of data in real-time, improving decision-making processes and operational efficiency. For instance, AI-driven hedge funds and fintech companies such as Square and PayPal, use machine learning for transaction analysis and fraud prevention, making financial markets more efficient and secure.

Consumer Discretionary Sector:

The Consumer Discretionary sector benefits from AI in areas such as personalized shopping experiences, inventory management, and targeted advertising. Retail giants like Amazon and Alibaba use AI for recommending products, optimizing supply chains, and enhancing customer service through conversational AI. This leads to increased customer satisfaction and operational efficiencies, driving growth in consumer-facing businesses.

Industrials Sector:

In the Industrials sector, AI is playing a crucial role in automation, predictive maintenance, and supply chain optimization. Companies like General Electric and Siemens implement AI in their industrial operations to predict equipment failures before they occur, optimize resource management, and automate routine tasks. This results in cost savings and efficiency improvements, making industrial operations more competitive and resilient.

Energy Sector:

AI is increasingly being adopted within the Energy sector for enhancing exploration and production processes, energy distribution optimization, and predictive analytics for equipment maintenance. Companies in this sector, such as BP and Royal Dutch Shell, use AI to analyze geological data for identifying oil reserves and optimize energy grids to manage demand and supply efficiently. These applications help in reducing operational costs and improving energy efficiency.

Overall, the sector diversification of AIQ enables investors to benefit from the broad application of AI technologies across multiple industries, which helps in balancing risk and capitalizing on the growth opportunities presented by AI advancements.

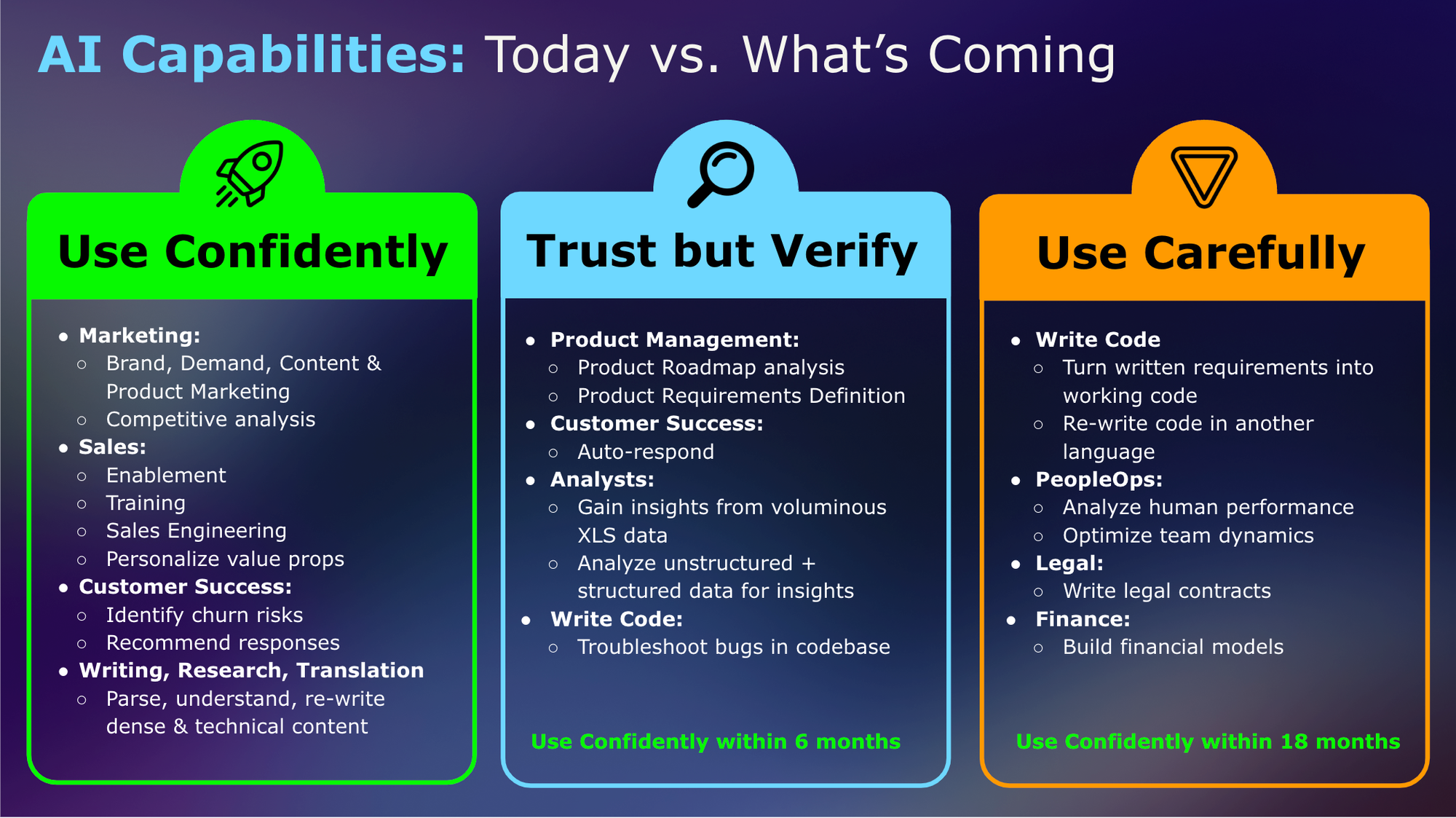

Pulling the trigger

I just invested in these three artificial intelligence ETFs based on my research, because I really believe that AI isn't taking jobs – it's taking parts of jobs, and as LLMs move from the "Use Carefully" to "Use Confidently" buckets, our lives will improve immensely.

This "shifting left" of AI capabilities and its impact on us as humans as we can offload the parts of our jobs we don't enjoy is also why Storytell's Vision is to Make Life Meaningful by Making Work Meaningful.

Footnotes:

[1] I say "$30" above because I find that many non-investors tend to think about stocks as being inaccessible to them. But in reality, some of the ETFs below cost as little as $30 for 1 share. And there's a world of difference between owning 0 vs. 1 share of something you believe in. My story below is no different if you want to make a $3 million dollar bet. Just invest as much as you can let ride for the coming years.

[2] Many of you are familiar with "Electronically Traded Funds" (ETFs), but if you're not, here's a quick primer: Think of an ETF as a basket of stocks. When you buy 1 share of an ETF, you're buying a small slice of the basket and getting exposure to all the stocks in that basket. The downside of ETFs is that they tend to have management fees, because someone is actively picking the stocks that should go into that basket. So while you could buy 1 share of NVIDIA for $104.75, you could also buy an ETF that holds NVIDIA but diversifies beyond just that one stock.